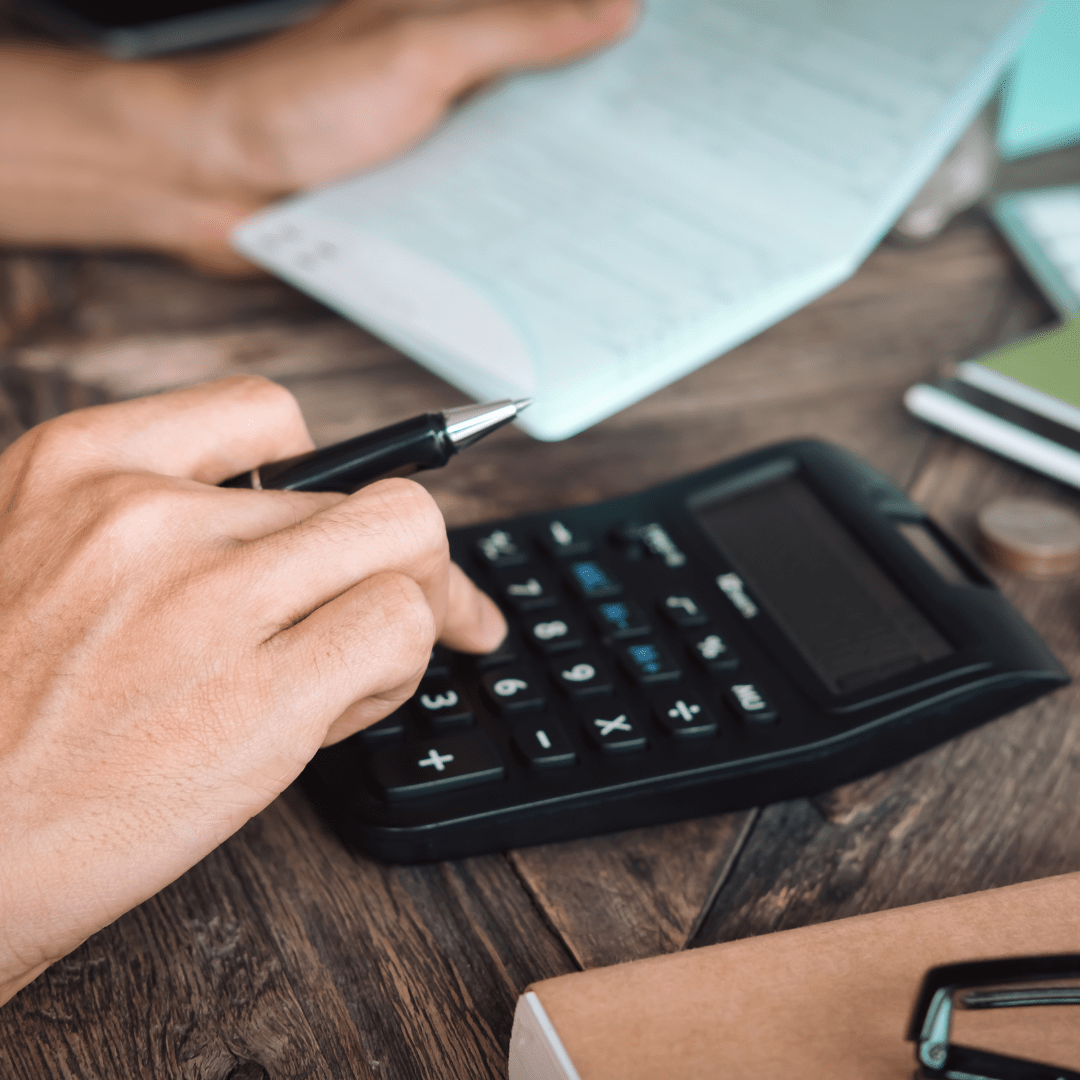

Research tax credit (“CIR”) receivable

Beware of the deadline for claiming reimbursement of the unused balance in the case of a fiscal year closed during the year.

The CIR can be used by the company to pay corporate income tax (“IS”) for year N and the following three years. It may then request reimbursement of the unused portion (except in special cases of immediate entitlement to reimbursement).

In a recent decision, the Toulouse Administrative Court of Appeal clarified how the deadline for lodging a claim can be set at either December 31 N+2 or December 31 N+3, depending on the tax assessment date. In practice, the deadline is shorter for some companies with a staggered financial year.

Principle: Companies that are taxed on an actual basis and incur research expenditure are entitled to a tax credit equal to 30% of the fraction of research expenditure not exceeding 100 million euros (5% above that).

The CIR is deducted from the corporation’s corporate income tax for the year in which the research expenditure was incurred.

If the amount of the CIR for the year exceeds the amount of the corporation tax due, this excess is not lost: the excess fraction constitutes a receivable from the State, which can be offset against the corporation tax due for the following 3 years.

At the end of this three-year period, the unused balance is reimbursed to the company on request (no spontaneous reimbursement).

If the fiscal year ends during the year, the CIR is calculated on the basis of eligible expenses incurred during the last calendar year prior to the year-end.

However, in terms of corporation tax, the right to reimbursement of the CIR arises on the date on which the balance statement is filed, which varies according to the year-end date.

The Conseil d’Etat has already ruled that a claim for repayment of a research tax credit constitutes a claim (notably CE 8-11-2010 n° 308672). The administrative court clarifies the starting point for the claim period in the case of a financial year ending on June 30, and draws the consequences for the end of this period.

CAA Toulouse 28-9-2023 n°21TL24510

Thus, the administrative judge specified that, depending on the deadline for submitting the balance statement, reimbursement could be requested up to December 31 N+2 or N+3 :

- For the majority of companies, those whose financial year is based on the calendar year, the end of the financial year is December 31 N, but mathematically the deadline for filing the statement of balance of corporate income tax is N+1; for these companies, the claim period is 3 years, i.e. until December 31 N+3 ;

- For companies with a financial year ending in year N, and for which the deadline for submitting the balance statement is also in year N (e.g. financial years ending on June 30 N), the deadline is shorter: the claim period expires on December 31 N+2.

![Contractual termination vitiated by employee malice [...].](https://www.nmcg.fr/wp-content/uploads/2024/08/Photo-article-85.png)