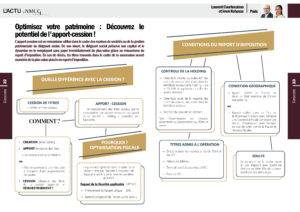

Optimize your assets: Discover the potential of contribution-cession!

Written on

31 January 2024

31 January 2024

The contribution-assignment is a mechanism used in the context of company takeovers or the management of the company director’s assets. During his lifetime, the company director preserves his capital and revitalizes it by reinvesting it without immediately paying any capital gains, thanks to the tax deferral mechanism. In the event of death, the shares transferred as part of the estate will be exempt from the capital gains tax deferred.

You may also be interested in this news

![Contractual termination vitiated by employee malice [...].](https://www.nmcg.fr/wp-content/uploads/2024/08/Photo-article-85.png)

Can a debtor who declares a creditor’s claim in the collective proceedings subsequently contest it?

Article

Jurisdiction of the Pre-Trial Judge to order an expert report in the context of a group action

Article

Dismissal for unfitness: linking the challenge to the employer’s breach of safety obligation

Article

Never inform an employee by telephone of his or her dismissal on the day the letter of dismissal is sent.

Article

The Distinctions

Subscribe to our newsletter to keep up to date with our content !

Register